Retirement Confidence: A Generational Perspective

Retirement planning is a cornerstone when striving for future financial security for many Americans. How we plan for and feel about our prospects for retirement, however, varies greatly by generation, as evidenced by a recent study.1 This study reveals a nuanced picture of how various generations perceive and prepare for retirement.

General Confidence

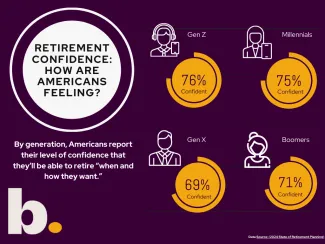

The good news: A significant majority of Americans express confidence in their ability to retire on their own terms. The study indicates that three out of four Americans feel assured about retiring “when and how they want.”1 When parsed by gender though, there's a gap in that confidence. Fully 80% of men feel confident about their retirement prospects, while only 68% percent of women report the same. And while the study doesn’t indicate reasons for the gender gap in retirement confidence, recent reporting and data have shown that women are now living five years longer on average than men, which means planning for a longer retirement2 and could contribute to some increased anxiety. I wrote on this previously.

Generational Insights

Breaking things down by generation, people still seem optimistic about their prospects in retirement, though notably, those closer to retirement age (Boomers and Gen X) exhibit slightly less confidence.

Gen X (born 1965-1980) and Boomers (born 1946-1964) exhibit slightly lower confidence levels at 69% and 71% respectively, according to the study. While Gen Z (born 1997-2012) and Millennials (born 1981-1996) report higher confidence levels, with 76% and 75% respectively feeling secure about their retirement plans. This younger cohort emphasizes debt freedom and career achievements as crucial retirement milestones. While the older cohort cites healthcare costs as a concern for their coming retirement years.

Retirement Priorities

Across all generations, spending time with family and friends ranks as a top motivator for retirement planning:

Gen Z: 31%

Millennials: 38%

Gen X: 41%

Boomers: 38%

“Pursuing a passion” also ranks highly as a motivating factor for Gen Z and Millennials, coming in at 21% and 19% respectively.

Among every cohort, however, the top motivating factor for retirement planning is, unsurprisingly, financial stability, with each generation indexing over 40% on this factor.

Traditional vs. New Retirement Trends

Interestingly, new trends are emerging post-pandemic as people think about and define retirement for themselves. These broadly fall into two groups: Traditional Retirement and “New Retirement.” 1

Traditional Retirement: The study defines this as “no desire to work” once retired. A substantial majority (62%) reported no intention of working after retirement, opting instead to pursue more traditional leisure and family time.

New Retirement Trends: Many plan to work part-time (57%) or pursue work for pleasure (68%) post-retirement, reflecting a desire for continued engagement and financial stability, as well as the wider availability and acceptance of remote and hybrid work.

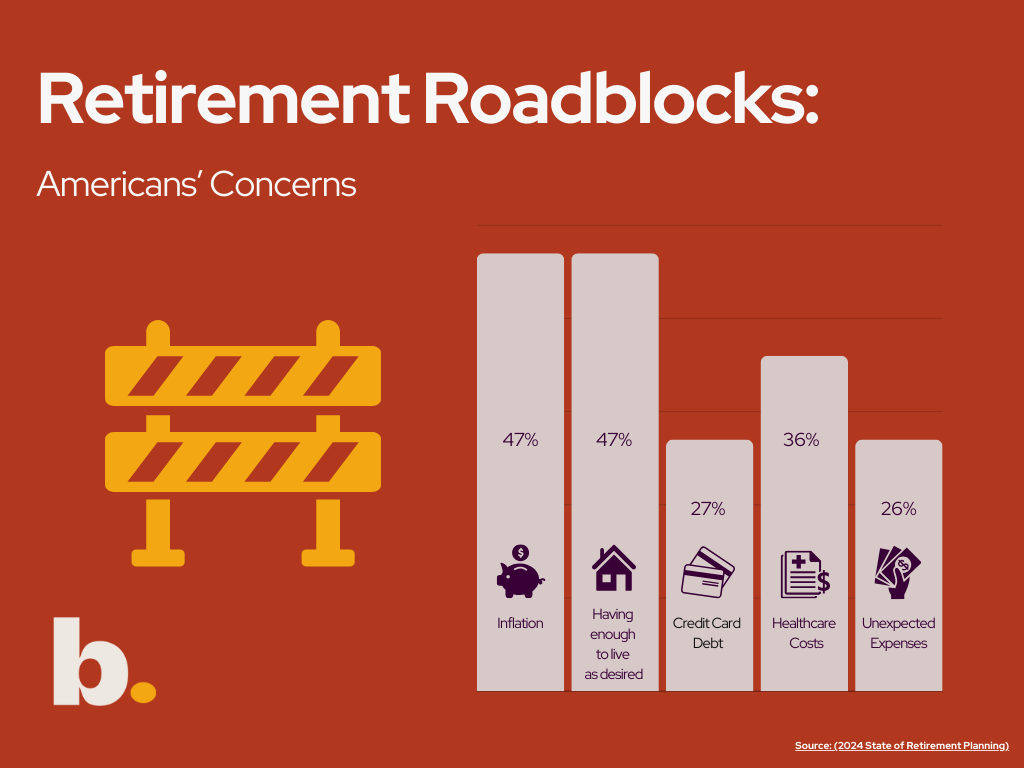

Challenges and Concerns

Despite reported confidence overall, several concerns persist among retirees and those nearing retirement:

Top concerns: Inflation (47%), having enough to live as desired (47%), and healthcare costs (36%) are high on the list.

Specific worries: Issues like health and mobility loss (46%) and running out of money are significant anxieties across all generations.

Financial Planning Insights

The study shows that, upon reflection, each generation wishes they had started planning and saving for retirement earlier. Which intuitively coincides with 25% of people who have already or are planning on delaying retirement. Among them, two-thirds report “financial necessity” as the cause for doing so.

I believe that early and strategic financial planning proves beneficial for everyone. But starting to save and plan at any time is better than not planning at all. Working with an investment advisor you trust can be a foundational step toward achieving your retirement goals.

As retirement expectations and realities continue to evolve, understanding these generational perspectives can be helpful. Whether embracing new retirement trends or navigating traditional expectations, financial preparedness and emotional readiness remain pivotal when in pursuit of achieving a fulfilling retirement.

Research and contributions by Joseph Malanga

1 Fidelity State of Retirement Planning Study, 2024

2 “How to Plan for a Longer Retirement,” by Carla Fried, Forbes, March 2023.